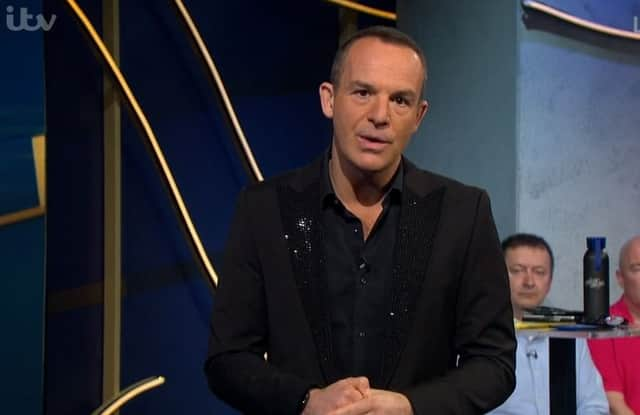

Martin Lewis’ important tip for all households earning less than £30k

Martin Lewis has issued an important message for every UK household with an annual income of £30,000 or less.

That is around half of the UK, wth the median income in 2020 being around £30,800, according to GoSimpleTax.

Advertisement

Advertisement

The MoneySavingExpert advised people that fall into this income bracket to do a simple check to help manage their finances amid the cost of living crisis.

Speaking during an hour-long episode of ITV’s Martin Lewis Money Show on Tuesday (8 March), Mr Lewis said: “If you have an income of less than £30,000 and you are struggling, it is worth spending 10 minutes on a benefits calculator to see what you are entitled to.”

There is an online benefits calculator on the government website which can be used to check what benefits you could get and how to claim.

You will need accurate information about your savings, income (including your partner’s), any existing benefits and pensions, outgoings (such as rent, mortgage or childcare payments), and your council tax bill.

What other tips did he give?

Advertisement

Advertisement

Mr Lewis also used the programme to encourage people in England who get more than 12 paid prescriptions per year to instead get an annual prescription certificate at £108.

This is a one-off payment which covers the cost of all prescriptions in 12 months.

In April 2021 prescription costs rose to £9.35 and prices are expected to go up again from 1 April, although the new charges for the 2022/23 financial year have not yet been announced.

The MoneySavingExpert also had a message for people thinking of using buy now, pay later services.

He said: “I am very concerned about buy now, pay later.

Advertisement

Advertisement

“It is a debt even if it is debt free. If you cannot pay it back, it’s difficult.”

Advice for prepayment customers

Mr Lewis’ money saving advice comes after he warned households to act ahead of Ofgem’s energy price cap increase in April.

Earlier this week he reminded people who are on older prepayment meters to check if they can “stockpile” energy now to beat next month’s price hike.

The maximum amount people can pay on standard energy tariffs (SVTs) is rising from £1,277 to £1,971 from 1 April - an increase of 54%.

Advertisement

Advertisement

But prepayment customers will be worst affected with a rise from £1,309 to £2,017, which is a £708 increase.

Mr Lewis said if people top up now and use this energy after the price cap changes, they will be charged for gas and electricity at the rate that applied when they topped up.

This stockpile trick sadly will not work for people who have smart prepayment meters as these are updated remotely with the new rates on the day of a price change.

He explained: “If you max out your top-up in March before the rate goes up, that's what you'll get, even if you then use that energy in April.

“So you can extend the cheap rate we have now for longer by maxing your top-up if you can afford it - and I know not everybody on prepay can.”